Banks are among the most important employers around the world and, given that they are institutions that manage and mediate money and financial transactions, are a part of a select group, together with the IT sector, technology, and suppliers of commodities, comprising the best-paying industries. Banks provide their employees with the most generous bonuses in relation to their base salaries of all the mentioned industries. Of course, banks also have a specific hierarchy of job positions, each of which has its own market value. Paylab examined bank salaries in more detail and compiled a ranking of the best-paying positions, based on 6507 answers from survey of CEE users in Slovakia, Czech republic, Hungary, Estonia, Lithuania and Latvia.

The best paid positions in banking sector

Dealer/Trader is the banking position with the highest salaries and they are responsible for managing securities, commodities, and foreign currencies on behalf of clients or the bank itself. The position with the next highest salaries at banks is internal auditor; they conduct audit activities at the bank’s head office, branches, and other organisational units.

The third highest-paying position is Product manager – specialist, who develops and innovates existing banking products and services. Another well-compensated position is Risk Specialist, who has the task of monitoring credit, market, operating, and strategic risks as well as liquidity risks that pose a potential threat to the bank’s assets and cash flow. The top five is rounded out by the position of Relationship Manager, responsible for the sales of bank products and services to corporate clients.

On which position you can make more money?

Salary differences in the banking sector

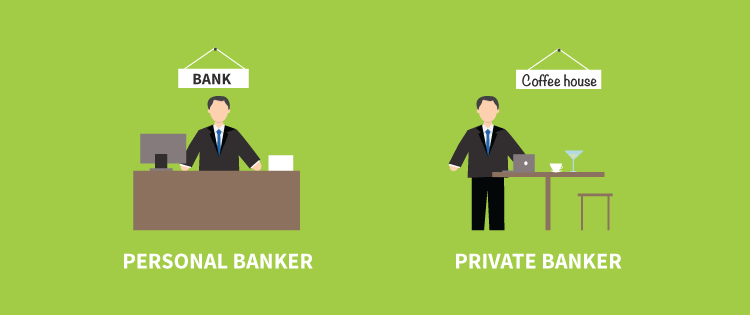

There are differences in salary based on assignment to retail or corporate clients for the positions of personal banker and private banker. While personal bankers care for an assigned portfolio of clients at a specific bank branch, private bankers are responsible for managing liquid assets, stocks, bonds, and real estate for bank clients with excellent credit, and their much higher salaries reflect this. The same can be said of a Relationship Manager, who functions as the contact person for companies and is inherently responsible for much larger financial volumes than a Client officer/teller, who is responsible for the active sales of banking products and services to retail clients. Paylab has also prepared a more detailed description of the individual job positions found in banks.

Description of key job positions in banking

1, Dealer/Trader

Purchase, keeping and sale of securities, commodities and foreign currencies in the currency of the clients and/or on the account of the bank.

Monitoring and verifying prices of the financial tools at the security exchange.

Following and analyzing the development on financial markets.

Exchanging information with colleagues and clients.

Preparing financial reports.

2, Internal Auditor

Drafting comprehensive plans and programs of audits.

Performing audit activities at the company’s headquarters and branches.

Checking compliance with internal regulations and the legislation.

Reviewing business and operational activities of organisations.

Processing audit outputs in the form of reports.

Making recommendations and monitoring the removal of any identified deficiencies.

Providing advice and consultancy within the scope of the auditor’s competence.

3, Product Manager – Specialist

Developing the new and innovating the existing bank products and services.

Monitoring and analyzing the competitive environment.

Following the fulfilling of goals in the area of product profitability.

Taking part in creating and setting the processes connected with products.

Directing and training new employees.

Analyzing and solving arisen operating problems.

Cooperating with other departments of the bank.

4, Risk Specialist

Identifying credit, market, operational, strategic and liquidity risks potentially threatening the assets and cash flow of the bank.

Developing methodology for measuring individual types of risks.

Designing and analysing measures to prevent risks.

Designing solutions to cover damage in case of risks.

Using external registers (e.g. credit register, register of Social Security debtors, etc.) in assessing risks.

Cooperating with product and project managers, underwriters and other bank departments.

5, Relationship Manager

Presentation and sale of bank products and services to the clients of the company.

Monitoring of the market and of the competitive activities in the entrusted region.

Searching for new clients.

Creating and developing business connections with the company’s clients.

Fulfilling of the stated personal business plan.

Taking part in fulfilling the financial and campaign plans.

Being in charge of the files and databases of clients.

6, Private Banker

Managing liquid assets, stocks, bonds and real estate of highly creditworthy bank clients.

Seeking out potential clients and their acquisition within their area of operation.

Detecting the individual requirements and objectives of clients with the intention to propose the optimal investment solution for the appreciation of their property.

Communicating with experts in asset management, real estate, lawyers etc.

Providing advice in the investment and real estate area.

Handling the special requirements of clients (e.g. booking tickets for an event, providing private jet transportation, etc.).

7, Financial Analyst

Preparing regular and ad hoc financial analysis.

Preparing statistics.

Developing weekly and monthly reports.

Taking part in developing financial plans.

Taking part in developing and improving controlling mechanisms.

Communicating with the high management members of the company and other departments.

8, Stock Broker

Making business transactions with clients.

Searching for potential clients.

Communicating with clients with the purpose of securing their needs.

Communicating with dealers/traders about the details of the business transaction.

Addressing clients on the phone with investment offers.

Providing clients with counseling in the area of investment.

9, Compliance Specialist

Assessing the legality of the bank’s entrepreneurial activity.

Monitoring the legislative standards and requirements of organs of supervision that are valid in the place of the bank’s activity.

Identifying the risks in the legislation and/or internal procedures.

Point out the potential risks to the superiors.

10, Custody Specialist

Securing the administration and custody of securities for clients.

Keeping clients informed about corporate shares concerning the administrated securities.

Carrying out operations with securities on the basis of clients’ orders.

Calculation and control of the current value of securities in the administration of the bank.

Paying returns from securities.

Representing clients and their interests at general assemblies.

11, Personal Banker

Taking care of the assigned portfolio at the bank branch.

Creating and developing business relations with clients .

Presentation and sale of bank products and services.

Fulfilling of the set personal business plan.

Taking part in fulfilling the financial and campaign plan.

12, Mortgage Specialist

Providing advice to clients regarding mortgage products and services.

Communicating with real estate agencies, building investors, authorities and other entities.

Acquiring potential clients.

Processing and assessing customers’ requests for mortgage loans.

Performing administrative tasks associated with the provision of mortgage loans.

Concluding mortgage loan agreements.

13, Claims Administrator

Recovering overdue receivables from the customers of a leasing company.

Registering and controlling overdue receivables.

Processing and sending written and e-mail reminders.

Communicating with debtors and other departments within the company.

Planning repayment schedules in the event of the insolvency of debtors.

Registering and checking payments in the system.

Preparing materials for the legal department.

14, Back Office Specialist

Processing of all types of client requests.

Entering and updating the information in the bank information system.

Drawing up and processing of contracts and contract amendments for individual banking products.

Archiving documents in compliance with the internal regulations.

Mastering internal regulations, general business terms and conditions, and business conditions for individual banking products.

Communicating with internal and external clients.

15, Card services Clerk

Processing applications for the issuance of credit and debit cards.

Communicating with companies issuing credit cards and bank branches.

Participating in the creation and updating of internal regulations.

Cooperating with project managers on new projects.

Solving complaints.

Assessing the suitability of motives on credit cards in your own design.

16, Client Officer

Active sale of bank products and of services to retail clients.

Opening and closing of bank accounts.

Realization of domestic and international wire transfers.

Accepting and issuing of cash in domestic and foreign currency.

Providing clients with counseling and information.

Carrying out administrative tasks connected with the provided services.

Fulfilling of the set business and acquisition plans.